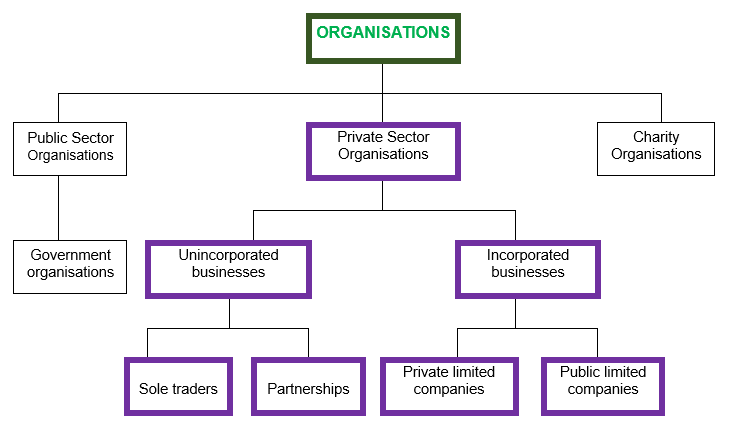

What are Incorporated Businesses?

WHAT ARE INCORPORATED BUSINESSES? Incorporated businesses are set up with Companies House and are governed by the Companies Act; and these require more stringent rules to be complied with along with the tax rules to comply with. The incorporation process establishes a company which becomes a separate legal entity from its owners. They are required … Read More