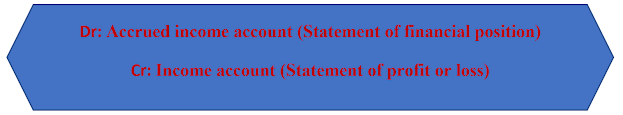

Accrued income is a sundry income amount outstanding and yet to be received by the end of an accounting period, so has not been entered into the ledger accounts.

In accounting for accrued income, the effect that needs to occur will be to increase the relevant income in an attempt to account for the total income due to the business in that accounting period and then to increase the asset- accrued income which is like debtors in that accounting period, recognising that the business is owed that amount.

Example:

You are working on the accounting records of a manufacturing business for the year ended 30 June 20X6. You are looking at the rental income for the year and this shows receipts for the following periods:

| July 20X5 – March 20X6 |

£990 |

| July 20X5 – December 20X5 |

£1,068 |

Calculate the value of the adjustment required for the rental income account as at 30 June 20X6 and show the journal entry needed for the relevant adjustment.

Solution:

|

|

Accrued income |

|

| July 20X5 – March 20X6 |

£990 |

£990/9×3= £330 |

| July 20X5 – December 20X5 |

£1,068 |

£1068/6×6=£1068 |

| Total accrued income adjustment needed |

|

£1068+£330=£1398 |

| Account name |

Amount |

Dr/ |

| Accrued income |

1,398 |

Dr |

| Rental income |

1,398 |

Cr |