Capital vs revenue expenditure

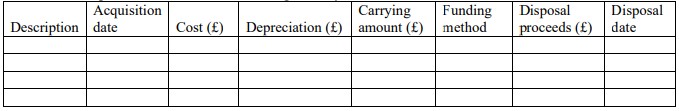

Capital and Revenue expenses Capital expenditure occurs when a business spends money in purchasing non-current assets for the business operations or when it spends money in adding value or improving an existing non-current asset. This will include delivery and legal costs in acquiring the non-current assets. Non-current assets are items owned by the business which … Read More