An accrual is an amount outstanding for payment by the end of an accounting

period, so has not been entered into the ledger accounts.

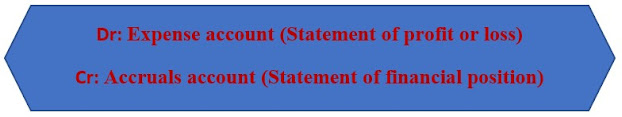

In accounting for accruals, the effect that needs to occur will be to increase the

relevant expenditure in an attempt to account for the outstanding transactions

which may not have been paid for and then to increase the liability in that

accounting period, recognising that the business owes that amount.

Example:

You are working on the accounting records of a business for the year ended 31

January 20X7. You are looking at the business rates expense for the year and

this shows payments for the following periods:

| February 20X6 – September 20X6- Office 1 |

£980 |

| February 20X6 – December 20X6- Office 2 |

£1,054 |

Calculate the value of the adjustment required for the business rates account as at 31 January 20X7 and show the journal entry needed for the relevant adjustment.

Solution:

|

|

Accruals |

|

| February 20X6 – September 20X6- Office 1 |

£980 |

£980/8×4= £490 |

| February 20X6 – December 20X6- Office 2 |

£1,054 |

£1054/11×1=95 |

| Total accruals adjustment needed |

|

£490+£95=£585 |

|

Account name |

Amount |

Dr/ |

|

Business rates |

585 |

Dr |

|

Accruals |

585 |

Cr |